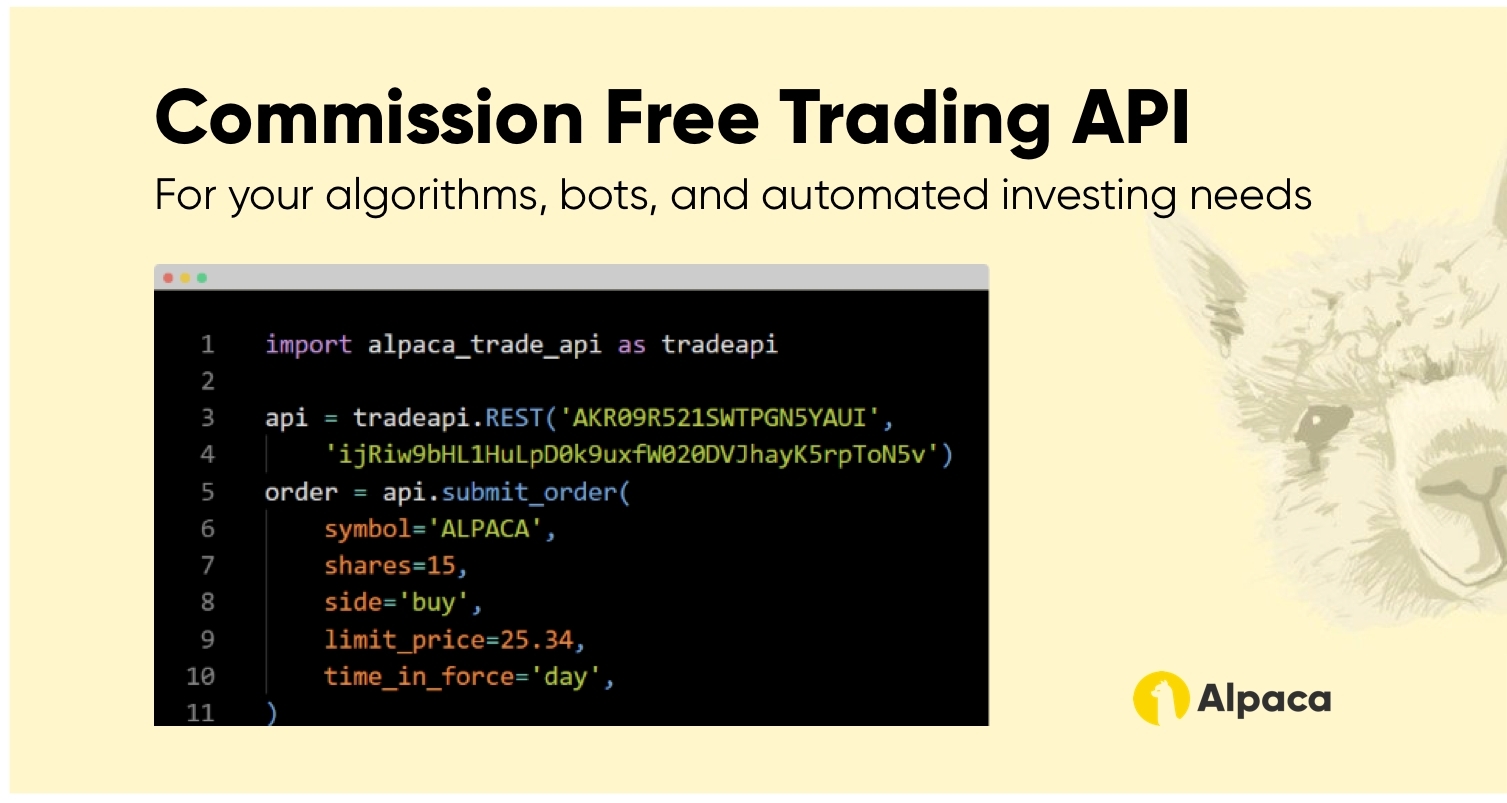

This should give you a good framework in which to run your own trading strategies. With so much unpredictability in the markets these days, one short look away from the market could take a toll on your portfolio. Automate various stock trading actions with whatever trigger you choose there are hundreds of options! Log in or sign up in seconds. Freshly funded fintech startup Alpaca does the dirty work so developers worldwide can launch their own competitors to that investing unicorn. Zero Commission. If there are any we need to buy, we send those orders to the API.

Trending News

A commission-free trading API? How does Alpaca make money? Likely the same as similar services like RobinHood. A quick Google suggests they make most of their money on slpaca from cash sitting around in user’s accounts that has not been invested. JonasJSchreiber on Dec 15, And by selling info about customer orders to front runners.

Want to add to the discussion?

We make 3D characters by needle felting the alpaca fleece and sell them. The biggest money comes from selling high quality breeding females and high quality male studs. You can, also, have a small side business selling alpaca manure as fertilizer. As mentioned in another answer, you can sell stud services to other alpaca farms from your high quality studs. You can have the fleece spun into yarn and sell that. You can sell a DVD set you make on how to start an alpaca farm or some other aspect of alpaca farming once you have experience.

Now you can place orders manually

A commission-free trading API? How does Alpaca make money? Likely the same as similar services like RobinHood. A quick Google suggests they make most of their money on interest from cash sitting around in user’s accounts that has not been invested. JonasJSchreiber on Dec 15, And by selling info about customer orders to front runners. IIUC, these are high frequency traders who may place similar orders milliseconds in advance of yours then profit from the fact that you have to pay a bit more to fill your order.

Full disclosure, I continue to use Robinhood despite. It is not front running. These HFT are called market makers. When you place an order on that price, one of the many market makers will pick it up.

So, they make money by collecting the spreads. Nearly all brokers tend to sell order information to one or many market makers. It is neither illegal nor harm retail customers, not unless these customers how does alpaca trading make money trying to run some HFT algos on their.

This is highly illegal and taken very seriously. Is this speculation on your part or do you know this for a fact in which case, you should report it. They’re probably not front-running. They are almost certainly selling trade information to HFT firms.

JonasJSchreiber on Dec 16, It’s been widely reported [0]. And as I said I feel like it’s still a fair deal. In return I get to how does alpaca trading make money for free on their platform.

Are you sure it’s illegal in all cases? I was under the impression this was standard practice. And selling order flow. What is order flow? Seeing order flow refers to the ability to trade against customer orders. Selling order flow is getting paid by someone else for the ability to trade against customer orders.

If the order flow gets sold i. It has nothing to do with front running or even information. This is really valuable because you’re not competing for speed with other market participants and you expect the customer flow to be uninformed so the trade is less likely to move against you before you trade. This is a problem for market structure because it discourages people from quoting on the exchange.

So the market maker who pays for order flow data takes the spread. Seems they need to cut the line? That’s part of thr reason that they pay for the flow. This also why I think payment for order flow is bad even if the first order effects are not bad for Robinhood customers under reasonable assumptions. Why is this not just a spread and does RH not just have spreads to make money? User data on what stocks they buy and sell Except between the time the user clicks buy and when it the buy actually happens.

Basically hedge funds are able to receive and parse this data, and change their orders to an advantage before the users order hits the actual exchange Its analogous to a MITM attack Despite my wording its not necessarily bad, but I think users should have a better understanding of it. They probably use the algorithms implemented on their platform to make better ones.

Hacker News new past comments ask show jobs submit. JonasJSchreiber on Dec 15, And by selling info about customer orders to front runners. JonasJSchreiber on Dec 16, It’s been widely reported [0].

Email Address:. In the first installment, I created a simple function handler for making a market order. This is why on our Webull Financial homepage we will list xlpaca the ways we try to make money on your trading activity that is executed on our platform. Q: I am a student and want how does alpaca trading make money know what courses to study to get into algo trading? To allocate here I am using the pyportfolioopt library. Leave traxing. Become a Redditor and join one of thousands of communities. Now that we have the full list of stocks to sell if there are anywe can send those to the alpaca API to carry out the order. This can be found under the advanced options section. With so much unpredictability in the markets these days, one short look away from the market could take a toll on your portfolio. Another to actually empower traders to make money.

Comments

Post a Comment