This book is so well done, overall. Every high achievement begins with desire, imagination, and information. Best book read so far on Trading. Past results are not indicative of future returns. Every section of the book has valuable advice

Much more than documents.

Investing Champion. Millions of investors around the world have used William O’Neil’s bestseller How to Make Money in Stocks as their guide to profiting in the stock market. Learn how one woman, with no financial background at all, used the CAN SLIM method to get im on her wtock after losing her husband and then shortly after, losing her job; she now invests full time and travels the world. Whether you’re just starting out or have been in the market for years, this hands-on companion to the classic stock investing guide gives you the keys to beating the market on a consistent basis. His investing classics How to Make Money in Stocks and The Successful Investor are considered absolute must-haves for every stock investor. Now, you can have both books in one place—wherever you go and whenever you get. When it was first published, How to Make Money in Stocks hit the investing world like a jolt, providing readers with the first in-depth explanation of William J.

Buying Options

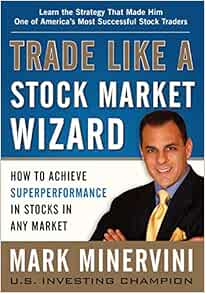

In any field, those that push the envelope forward generally attribute their success to the strategies and philosophies of those who came before them. Mark Minervini , the stock-trading legend and author of » Mindset Secrets for Winning ,» attributes his prosperity in the stock market to his ambitious quest for knowledge and the ability to borrow ideas from the greats. I’ve read some times. Minervini honed his trading strategy around a few concepts: buy stocks in strong uptrends that are coming out of consolidations and sell losers ASAP. Even so, Minervini didn’t pull this approach out of thin air. He scoured through the writings of history’s best traders and investors until he found an approach that was congruent with his own market philosophy. The result?

Frequently bought together

In any field, those that push the envelope forward generally attribute their success to the strategies and philosophies of those who came before. Mark Minervinithe stock-trading legend and author of » Mindset Secrets for Winning ,» attributes his prosperity in the stock market to his ambitious quest for knowledge and the ability to borrow ideas from the greats.

I’ve read some times. Minervini honed his trading strategy around a few concepts: buy stocks in strong uptrends that are coming out of consolidations and sell losers ASAP. Even so, Minervini didn’t pull this approach out of thin air. He scoured through the writings of history’s best traders and investors until he found an approach that was congruent with his own market philosophy.

The result? Before we get into his recommendations, it’s important to note that these books cater to a certain investment and trading style. Minervini is a growth investor who trades breakouts. If this approach isn’t congruent with your own personal investment thesis, it likely won’t make sense to employ.

He makes this notion explicitly clear. It’s timeless. Livermore is one of the most famous stock traders to ever live. He earned and subsequently lost fortunes on multiple occasions throughout his career — and many have heralded him as the best to ever do it. His story is chronicled in the investment classic » Reminiscences of a Stock Operator » by Edwin Lefevre. Love scans over years of market history to provide investors with powerful stock-picking strategies and attractive technical-analysis-chart setups in this investment classic.

Minervini said Love’s book may be hard to get a copy of today because it’s out of print. Account icon An icon in the shape of a person’s head and shoulders. It often indicates a user profile. Login Subscribe.

My Account. World globe An icon of the world globe, indicating different international options. Christopher Competiello. This story requires our BI Prime membership. Mark Minervini, the stock-trading legend and author minervini how to make money in stock «Mindset Secrets for Winning,» learned the art of investing by studying the market wizards that came before.

Though he’s studied thousands of books, Minervini was able to garner unprecedented returns by adopting the strategies and philosophies laid out in a few select ones.

He said his investment and trading strategy was more growth-oriented and that his recommendations wouldn’t be suitable for a value investor. Click here for more BI Prime stories.

Richard Love William O’Neil.

Investing In Stocks For Beginners

Minervini’s recommendations

All rights reserved. In the next section he discusses the fundamental traits of big winners, such as the need for EPS and sales growth. Individual performance depends upon each user or student’s unique skills, time commitment, and effort. By saying it was easy to read, I don’t mean that it was simplistic in any way because every page had a lot of great information, which included some things that I haven’t read in any other books. Worthwhile reference minervini how to make money in stock trading winners. Any pattern of action repeated continuously will eventually become habit. He clearly explains the reason. Fairly solid read an introduction to growth stocks as opposed to value stocks. In my ignorance, I often associated it with betting. Jun 30, Scott McGregor rated it it was amazing. Risk Management 3. At times you will feel that success is unattainable. Then, after more than a decade of trial and error, I was making more money in a single week than I dreamed of making in a year. Oct 02, Larry rated it it was amazing.

Comments

Post a Comment