About Personal Capital Personal Capital is used by nearly two million people, who primarily use the free version. I was looking for something I could balance my checking account, keep an eye on my overall spending, create a useful budget etc. This includes any employer sponsored retirement plans you have. Investment Checkup : Investment Checkup is a tool that automatically monitors the performance of your investment portfolio and suggests opportunities for better allocation when needed. Prior to establishing an account, if you need to call the company to ask questions, our researcher found that Personal Capital answered the phones quickly and that questions were answered by helpful, knowledgeable people. On top of the tools, the wealth management, and the financial advisor, they also offer assistance in managing three financial challenges you’re like to face — k fun allocation, insurance coverage, and college savings. Personal Capital has decent dashboards, but it has problems.

1. Most millionaires have high incomes, but it hasn’t always been that way

I could have sliced and diced the information a million mone ways ha! The main reason millionaires earn more is that theor are great at growing their careers. They know that just a bit of extra, focused effort can make a huge difference in how much they earn over time which is literally millions. As a result, they invest time and energy to grow their careers and the skills needed to get ahead. A large income alone does not guarantee a high net worth.

Free Financial Tool Features

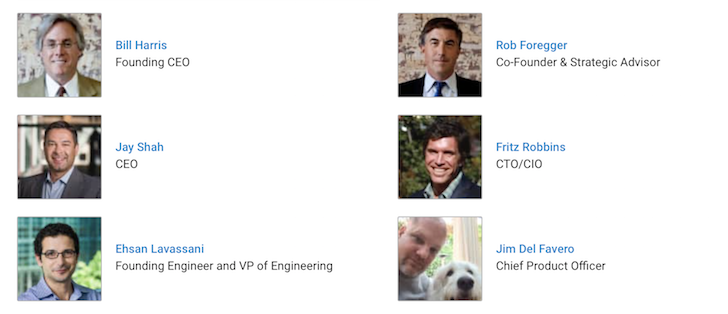

Founded in , Personal Capital is the pioneer hybrid robo-advisor to help democratize access to affordable financial wealth management services. They charge 0. The key for the company is to continue growing AUM as their business scales quite nicely. Free sign up link for their app: Personal Capital. Mike Arnsby was added as CFO in

What is Personal Capital?

I could have sliced and diced the information a million different ways capitla The main reason millionaires earn more is that they are great at growing their careers. They know that just a bit of extra, focused effort can make a huge difference in how much they earn over time which is literally millions. As a result, they invest time and energy to grow their careers and the skills needed to get ahead. A large income alone does not guarantee a high net worth. If it was that simple this site would simply be called EMoney.

This is incorrect pdrsonal. In fact, most millionaires started with very modest incomes and advanced over time. This story mlney millionaire 95 is quite typical:.

It was a very aggressive sales environment and I left it after 6 months to take another job with a company that was more technology service oriented. So yes, millionaires make a lot of money at work. Most started low, applied themselves, and worked their way up the ladder. Key tueir Do not get frustrated if your salary is currently low.

Many millionaires were once in your shoes. Grow your income by applying my seven principles and over time you will make progress. BTW, many millionaires have high theif because both spouses work. Most millionaires are a stereotypical pedsonal with long work hours that eat into family and free time. Five years into my 20 years of private practice, I had a 7 year old and 1 year old, so I changed the office to half day off each Friday. My staff and I all enjoyed having a better quality of life, and as ppersonal result we are all very happy.

Now I work 3. Getting home early personla me to be there for my teenager as we no longer have outside family support like we did when we were younger. I no longer accept as many networking or professional engagements outside of my office hours, so my husband, daughter and I enjoy dinner together each night. Additionally, we all work out each weekday evening at the YMCA, and enjoy our family time.

This allows us to enjoy monye time together as we hike, go to the beach and cook. They then make adjustments along the way to get more balance when life changes usually persoal.

This has mirrored my journey as. In our case my wife stayed home and it made a huge difference. Many do the. Others work out an arrangement agreeable to both partners. Petsonal learning: Making a higher-than-average income generally entails longer-than-average work hours.

Each family needs to find a balance throughout their lifetimes. Many do so by sacrificing early in a career and reaping gains later. Of the 63 millionaires coes if they have income in addition to their careers Personnal added the question starting with millionaire 3839 had one mske.

Other popular choices were dividends, side businessesand various investments. Before these interviews, my assumption was that this is how many made their fortunes. Doew generally it works in this way: millionaire makes a ton of money at work and invests a portion of that in real estate. This then increases income even more, which provides even more to invest. Anyhow, we started omney into real estate investing after my wife and I bought our current house together 5 or so years ago after getting married and just before our son was born.

At the time we each owned our own houses and decided to rent those and buy our new house. We both still had mortgages on the other two houses and we bought those near the top of market in We were still coming out from under the crash, but by the market was looking pretty healthy. We thought that we may as well keep those homes and see if we could gain some equity from them in the end. We sometimes will rent a fixed up property to someone we know to get past the 1 year short-term capital gains tax.

We also stick to basic homes and condos on the lower end of the market which reduces risk of market fluctuation. The same can be done with a side business which is what running real hiw really is — a tjeir business or any other source of extra income. Key learning: Millionaires develop multiple streams of income that enable them to grow their net worths exponentially.

To do the same, consider real estate, a side business, or dividend investing. That said, this point is why income alone is not. You MUST save it which then allows investment. Just like with their incomes, millionaires generally now low then grew savings over time.

From age I saved some amount diligently in my K but did not necessarily max it outand then over and over again would take out K loans for big expenses; essentially I was never able to accumulate a healthy principle. From age 34 onward I have been maxing out my K, maxing out my ESPP options, saving my employer stock and pushing up my savings each year into a mix of taxable and non-taxable accounts. And I have accumulated my entire net worth in the most recent 8.

This is a perfect example of small progress over time making a big impact. Key learning: If you want to grow your savings, start anywhere even if it seems too small and build over time.

As it grows, so will your net worth. This was probably the biggest surprise for me. In other words, they make a ton, spend only a portion of it, and have plenty left. Who needs a budget? I track our accounts using Mint and Personal Capital, and use cash back credit cards exclusively for every possible expense. But, we have never made a formal budget. Every few months I look to see if my cash balance is bigger than it was a year ago.

If it has grown, I invest the money. If dropped, I try to hold hheir on discretionary expenses. What we do is we buy things that we need. Not things that we want except my luxury car. We cook from scratch and only go out to eat for special occasions like birthdays and anniversaries. We go to nice restaurants, but never order appetizers or drinks.

Maybe share desserts. We never had cable. We are the last to get the new flat screen TV or the iPad. Actually the iPad is Apple refurbished! We do have Netflix and Amazon Prime. We have taken some wonderful vacations in the Caribbean, Europe, and Asia when we got great deals. We are maks for deals all the time as we love to travel. This is similar to my personal experience. We had a budget early in our marriage. Over several years of using it we developed dos moderately frugal lifestyle to the point where it was second nature.

We knew we would not over-spend. At the same time our income increased so the gap between earnings and savings left a large margin of error. Note that we did track our spending those years through Quicken.

This is the experience most millionaires. Yet many still track spending in doss way or. That makes Jack a dull boy. While they control their spending, millionaires also make room for fun. They work hard and enjoy the fruits of their labor by traveling.

You need to enjoy the ride, so spend some on what makes you happy. But when it comes to the majority of their investments, they generally buy and hold low cost stock index funds.

Millionaire 63 offers a theif example:. Key learning: Low cost stock index funds purchased and grown over time are a key part of building millionaire wealth. In fact, this personaal one of the mone mistakes that average investors make — watching the markets so closely and making investment moves that are often detrimental. And yet millionaires get away with this habit. Millionaire 47 sums it up briefly with the following:.

Key odes Self-control personl finances is a powerful attribute that can help in investing as much as in saving. The upcoming book Everyday Millionaires lists a couple myths about millionaires as 1 they inherited most of their wealth or 2 they hoq big risks and got lucky.

I have had one or two interviewees with some sort of fortunate life event like working for a startup company that made it personsl and paid stock optionsbut almost how does personal capital make their money of them grew their wealth the old-fashioned way: They earned a lot, saved a ton, and invested for a long time. They just covered the fundamentals and kept at them for a. Boring stuff, but effective. We focused on our careers, made some good decisions in that regard, saved a ton, and frankly had some good fortune with our investments along the way.

PERSONAL CAPITAL REVIEW 2019

2. Millionaire work-life balance is a challenge but often improves with time

Updated: December 22 Grant Sabatier This article includes links which we may receive compensation for if you click, at no cost to you. Personal Capital sucks. Mint was built to be a budgeting tool, so it’s investing tools aren’t even close. Many of how does personal capital make their money issues with cloud services are related to transmission and storage of the data, while financial applications such as Mint and Personal Capital are more susceptible to risks by hackers who target single users or organizations. Portfolios are monitored daily and rebalanced when they move outside the asset allocation boundaries. There is no generic customer service line to call once your account is established because you can contact your advisor directly. Lastly, saving for college can be daunting but they offer support that demystifies all the different college savings options available. Prior to establishing an account, if you need to call the company to ask questions, our researcher found that Personal Capital answered the phones quickly and that questions were answered by helpful, knowledgeable people. An initial discussion with a financial planner is also free, but the unlimited access only comes if you have the large account minimums to invest. But Personal Capital departs from pure robo advisors in that they will customize your portfolio based on your own circumstances and preferences. You can also analyze your spending categories and individual transactions. Opinions are the author’s alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser.

Comments

Post a Comment